Choosing a manufacturing hub is a critical decision. With shifting tariffs and supply chain risks, making the right call between China and Vietnam has become more complex than ever.

China excels with large-scale orders, complex designs, and rapid development due to its mature ecosystem. Vietnam is compelling for brands seeking tariff diversification, lower MOQs, and a simpler production process, especially for basic pressed aluminum or stainless steel items. Your best choice depends entirely on your product's complexity.

For over 27 years, I've helped hundreds of clients navigate this exact decision. I've seen brands thrive by choosing the right partner and others struggle by making assumptions based on headlines alone. The reality is that the best location isn't about which country is "better," but which one is the better fit for your specific needs—your products, your volume, and your growth strategy. The details matter, so let's break them down.

Does "Made in Vietnam" Really Mean Lower Costs for Cookware?

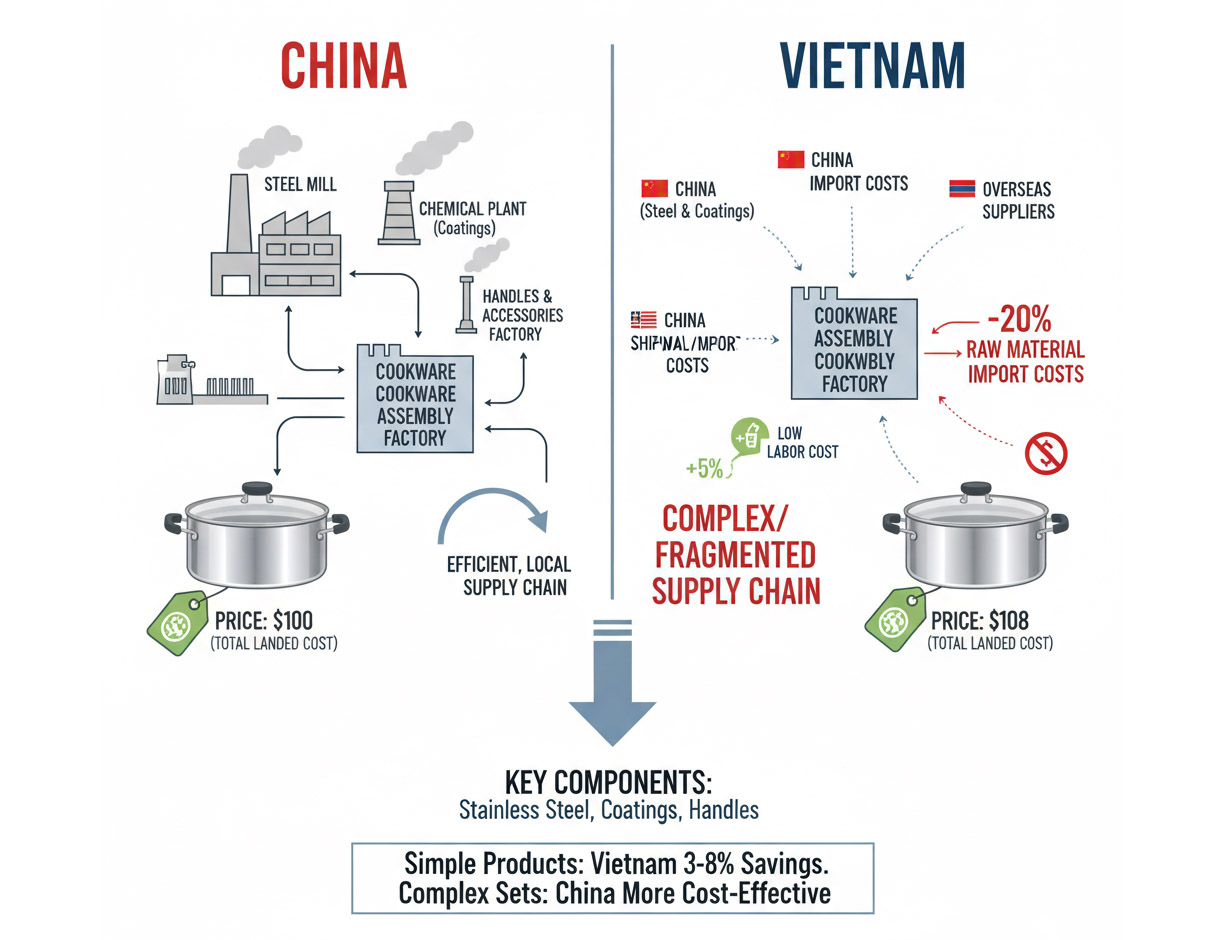

You hear that manufacturing in Vietnam is cheaper. But hidden costs from imported materials and less efficient supply chains can erase those savings, leaving you with an unpleasant surprise.

While Vietnam offers lower labor costs, this advantage shrinks when you factor in imported raw materials like stainless steel and coatings, which often come from China. For simple products, the total landed cost savings might only be 3-8%. Complex cookware sets remain more cost-effective in China.

Over the years, I've seen many clients focus solely on the factory's per-unit quote. This can be misleading. A lower labor rate in Vietnam looks attractive on paper, but it's only one piece of the puzzle. The most significant costs in cookware manufacturing are raw materials. China has a massive, vertically integrated supply chain for stainless steel, aluminum, handles, and specialized coatings. Vietnam's manufacturing ecosystem is growing, but it still relies heavily on importing these key components, often from China. This means you end up paying for Chinese materials, plus shipping, to a Vietnamese factory. Let's look at a simple breakdown.

Cost Factors: China vs. Vietnam

| Factor | China | Vietnam |

|---|---|---|

| Labor Costs | Higher, but offset by high efficiency. | Lower, providing a direct cost advantage. |

| Raw Materials | Abundant and sourced domestically. | Often imported, adding cost and logistics. |

| Landed Cost | More competitive for complex, multi-part items. | 3-8% cheaper for simple, single-material items. |

For a basic pressed stainless steel bowl, Vietnam can offer a clear price advantage. But for a 7-piece cookware set with induction bottoms and a non-stick coating, China's ability to source everything in-house makes it the more affordable option.

Can Vietnam Match China's Production Speed and Scale?

Your business depends on reliable, fast turnarounds. But production delays from a new supplier can halt your momentum and cost you sales, especially during peak seasons.

China maintains a significant lead in production speed and capacity. Its mature supply chain allows for initial orders in 45–75 days, while Vietnam typically requires 55–85 days. This gap is largely driven by Vietnam's reliance on imported tooling and a less developed component network.

When we start a new project, one of the first questions I ask is about volume and timeline. The answer helps determine the best manufacturing location. China's manufacturing infrastructure is unmatched. At Inoxicon, our 95 advanced machines can produce over 30,000 pieces a day. This is possible because the entire ecosystem—from steel mills to handle suppliers to packaging printers—is located within a short distance. This integration allows for incredibly fast DFM (Design for Manufacturing) iterations and rapid prototyping.

Speed and Scale Factors

In Vietnam, the manufacturing landscape is more fragmented. If a project requires custom tooling, there's a good chance the mold will be made in China and then shipped to Vietnam, adding weeks to the timeline. For repeat orders, this gap narrows as the supply chain is already established. However, for large-scale production or complex assemblies requiring multiple suppliers, China’s density and experience provide an unbeatable advantage in speed and efficiency.

If you need a million units of a new product line delivered in three months, China is your only realistic option today. If you are launching a new brand with a simpler SKU and need a lower MOQ to test the market, Vietnam’s slower pace might be a perfectly acceptable trade-off.

Is Quality and Compliance a Gamble Outside of China?

You need products that meet strict international standards like FDA and LFGB. A compliance failure not only blocks your shipment but can also permanently damage your brand's reputation with customers.

Both China and Vietnam can produce cookware that meets LFGB, FDA, and REACH standards. However, China's ecosystem is more mature, with a wider network of in-house testing labs and accredited coating partners. Vietnamese factories are improving but may rely on Chinese supply chains for certified materials.

For over two decades, ensuring product compliance has been a non-negotiable part of my work. I can confidently say that high-quality, compliant manufacturing is possible in both countries, but the process is different. In China, the supply chain is so established that sourcing certified materials is straightforward. For instance, when a client needs a specific non-stick coating that is LFGB-certified, I can connect with several pre-vetted suppliers who have all the documentation ready. Most established manufacturers like us have in-house testing capabilities for basic checks, which speeds up the development process.

Compliance and Quality Ecosystem

In Vietnam, the path to compliance can require more hands-on management. While the factories themselves can adhere to strict quality control, they might source their raw steel or coatings from a third party, which in turn sources it from China. This adds layers to the verification process. You have to trace the material's origin to ensure its certification is valid. The local testing infrastructure is also less developed, meaning samples often need to be sent abroad for final certification, which can add time and cost.

Ultimately, the key isn't the country but the partner. A good manufacturer in either location will have transparent processes for material sourcing and a rigorous quality control system in place. They should be able to provide full documentation for all materials used.

Conclusion

China is best for scale, complexity, and speed. Vietnam is a strong choice for simpler products, tariff flexibility, and lower MOQs. Your product and business goals will determine your best partner.